Content

For more detailed information refer to Publication 583, Starting a Business and Keeping Records. Under UK domestic law, a company may have a duty to withhold tax in relation to the payment of either interest or royalties . The circumstances in which such a liability arises are discussed below. These reports indicate the payment amount and the amount of the tax withheld in local currency for each supplier and invoice. The upper limit defines the maximum amount for which withholding tax is calculated within the same year or period. If the withholding level is set to invoice, calculation is only performed if the calculation base amount of the invoice is lower than the upper limit.

The account is created in the Liabilities group, because the money it represents technically belongs to your suppliers until it is eventually used to pay taxes owed on their behalf. When a tax filing is made, the balance of Withholding tax is available to offset your tax due. Indicate the amount being applied on the appropriate forms of the tax authority and submit with your filing. This step in the process does not occur in Manager, only in your tax filing. As implemented in Manager, withholding tax does not refer to deductions on payslips of taxes due from employees.

Department clarifies instructions for pass-through entities

Payment was made prior to 1 June 2021 (or 3 March 2021 where anti-abuse measures are applicable) of an amount that would have qualified for exemption under the EU Interest and Royalties Directive prior to Brexit. If none of the exceptions apply, a payment of interest must be made after the deduction of WHT unless HMRC has given authorisation that the payment may be made gross because of the applicability of treaty relief for the recipient. The lower limit works as the upper limit but defines the minimum amount instead. If the withholding level is set to invoice, calculation is only performed if the calculation base amount of the invoice exceeds the lower limit. If so, the withholding percentage is applied to the full calculation base, not only the part exceeding the limit.

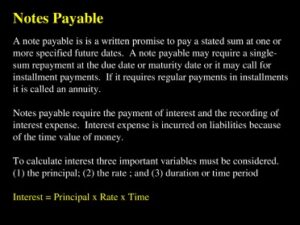

Is creditable withholding tax a current asset?

Improper claiming of creditable withholding tax

The BIR Form No. 2307 shows that the tax withheld by your suppliers are tax deductions or creditors from income tax liability. On books, it is treated as an asset and sometimes, the financial statements would display such asset amount that could have been used.

Late Payment Penalty – There is a 5% penalty on any tax that is not paid by the deadline or $5 . It is computed from the filing deadline to the date when all tax, interest and penalties are fully paid. Interest is not collected for the first month a return is filed late. A business is considered to have nexus in Philadelphia and is subject to BIRT if it has generated at least $100,000 in Philadelphia gross receipts during any twelve month period ending in the current year. Regardless of whether your business qualifies for reductions or exemptions, you’re still required to file a BIRT return.

Payments, assistance & taxes

The other type of corporation is a public limited liability company (naamloze vennootschap or “NV)”. The capital of a NV should amount to at least €45,000 and is divided into shares. In principle, the shares are freely transferable and cannot be issued without voting rights or profit rights. The NV is mainly used for corporations that are very large and/or Account For Withholding Tax On Sales Invoices will be listed on the stock exchange. Legislative proposals have been accepted by the Dutch Senate for trusts and ‘similar legal structures’, such as the Dutch mutual fund (“fonds voor gemene rekening”), to also be required to register their UBO. These legislative proposals are expected to enter into force, by Royal Decree, as of October 1, 2022.

Certain anti-abuse provisions restrict the possibility to carry forward interest costs in the case of a change of control. If an entity forms part of a Dutch fiscal unity, the EBITDA rule applies to the fiscal unity as a whole and not to each single entity that forms part of the fiscal unity. An acquisition or expansion by the Dutch taxpayer of an entity that will become a related entity after the acquisition or expansion.

Interact with 311 online

Businesses will generally use the location code and tax rate corresponding to the location where their goods or the product of their services is delivered. One exception is if the services performed meet the definition of ‘professional services’ found in statute. ‘Professional services’ are services that either require a license from the state to perform or require a master’s degree or better to perform. Please see FYI 200 for more information on choosing the correct location and tax rate for your receipts. If your customer pays their invoice but withholds tax, use a credit memo to charge off the withholding tax as an expense. The acquisition of shares in a real estate company is subject to real estate transfer tax if a substantial interest is acquired.

The founders of the BV will determine the issued capital and required paid-up capital. In a general partnership, all partners are personally liable for the debts of the partnership. Creditors can make a claim on the partners’ personal assets if the partnership is not able to satisfy its debt obligations.

Corporate income tax

The rule only applies if the CFC is a tax resident in a jurisdiction that is included in a list annually reviewed by the Ministry of Finance. In October of each year, the Ministry of Finance publishes a draft list for discussion. Jurisdictions are included on this list if they do not have a profit tax or a statutory profit tax rate of https://kelleysbookkeeping.com/ less than 9%, or if they are on the EU’s list of non-cooperative jurisdictions. The participation exemption also applies to losses achieved by participations. The only exemption is if a participation is formally dissolved. This legislation is subject to several anti-abuse provisions in order to avoid the erosion of the Dutch tax base.

How do I post an invoice with withholding tax?

- Enter the Vendor ID (Withholding Tax Enabled )of the Vendor to be Invoiced.

- Enter Invoice Date.

- Check Document Type Vendor Invoice.

- Enter Amount for Invoice.

- Select Tax Code for the Tax Applicable.

- Select Tax Indicator “Calculate Tax”.

- Enter the Purchase Account.

Depending on the nature of the goods or services, the supplies are domestically sold at the standard VAT rate of 21%. A reduced VAT rate of 9% applies to certain food and beverages, pharmaceuticals and specific labor-intensive provisions of services. The 0% VAT rate applies to intra-EU supplies of goods and exports of goods to non-EU jurisdictions, as well as certain services provided in relation to the mentioned exports.