Content

The bank’s use of the term debit memo is logical because the company’s bank account is a liability in the bank’s general ledger. The bank’s liability is reduced when the bank charges the company’s account for a bank fee. Hence, the credit balance in the bank’s liability account is reduced by a debit. Maybe you have seen one before in one of your bank statements, such as for your checking account. However, in order to maintain a proper audit trail, many jurisdictions do not allow invoices to be edited after being issued. That is when a credit memo comes in, enabling a seller to reduce the accounts receivable balance by the required amount without deleting the invoice itself from the financial records.

One of the types of debit memos is the ones that are used in incremental billings. It is an incremental debit that should be included in the main invoice. A debit note, often referred to as a debit memo or memorandum, is a commercial seller’s, buyer’s, or financial institution’s notification of a debit placed on a recipient’s account in the sender’s books. In banking, fees are deducted from an account automatically, and the debit memo is recorded on the account’s bank statement. Both a debit memo and a credit memo inform clients of a change in their account status. Customers are informed by a debit memo as to why their account balance has decreased or why they now owe more.

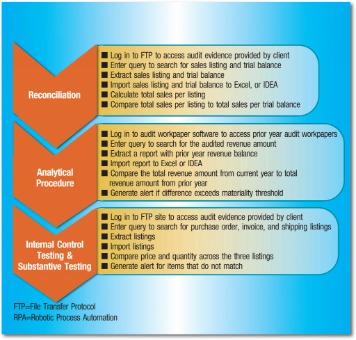

Memo posting

In regard to recording a credit memorandum, the buyer records the memo in its accounts payable balance as a reduction. The seller, then, must also record the memo as a reduction, but it is a reduction of its accounts receivable . A credit memorandum – often shortened to credit memo – is given to a customer by a seller that provides goods and/or services. The memo is issued as a way to reduce the amount owed by the customer. The deduction is taken from an invoice that was previously issued, which is the most common type of credit memorandum.

A credit memo, on the other hand, gives you credit toward your next purchase from the same merchant. If provided by store A, it cannot be used to purchase an item from store B, nor can it be redeemed for cash. Credit memos are usually issued because of a price dispute or a buyer returning goods. It’s crucial to remember that the account is debited in the sender’s records, not the recipient’s when it comes to the entire phase debit memo. The good news is we put together this guide to cover the most important pieces of information.

How Is a Money Market Account Different Than a Checking Account?

When the latter occurs the bank will transfer the collection of funds into the depositor’s account. In certain circumstances, a debit memo is typical in the banking business. When a bank charges fees, for instance, a bank can send a debit memo to a specific bank account. When a customer is accidentally undercharged for goods or services provided, a debit memo gets issued.

Receipt Maker Generate receipts within seconds through this invoicing software. Real-time Notification Get notified whenever estimates and invoices are opened or payouts proceeded. The maximum allowable transfer of funds between two budget categories is 10% of the total sub-grant. Transfer larger than 10% require Home Office approval, and are subject to USDA approval. This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don’t own or control the products, services or content found there.

How to Settle a Credit Memo

The temporary transaction created as part of the memo-posting will be reversed/removed after the actual transaction is posted in batch processing. A debit memo can also be used to correct an accounting error that resulted in a residual balance if the additional money in a customer’s account what is a memo on a bank transfer is that. To record the net amount of a successful debit and credit transaction, you can create a debit memo reversal. When a customer pays too much, the extra can be offset with a debit memo. This allows the accounting department to clear it out by sending the memo back to the customer.

Credit memo is a short form of the more formal term “credit memorandum”, which is also known as a “credit note”. Credit memorandums are usually issued because of a price dispute or a buyer returning goods. The actual transaction to record a withdrawal using ATM will be posted to accounts in the EOD batch. Both notes notify customers about a change in their account balance either by increase or decrease. It gets created and then sent off to a supplier that also includes a note that explains what it’s for. If a company completes an order and invoices the client for less than the agreed amount, they send a debit memo to indicate and detail the balance.

For many customers, looking at just their primary checking account would convey an incomplete picture of their spending. For instance, many customers use a credit card for a given kind of expense one day, and then use a debit card or paper check on another day. Banks that offer categorization typically allow customers to run reports across accounts held with the bank. For example, Cindy works for Fluffy Stuffs Inc. as a part of its sales staff.

- Traders use it for financial adjustment, not a typical transaction.

- A memo post is a transaction that has not yet been posted but is included in the current day’s available balance until the nightly ledger update.

- Bank fees are one reason a bank may use a debit memo to decrease an account balance.

- Later, this entry will be removed as part of the EOD batch process.

- In other words, a bank debit memo reduces the bank account balance similar to a check drawn on the bank account.

You are using the website of © 2023, Dundas Life Inc. (FSRA #37628M). Dundas Life is a digital insurance brokerage who sells (ie. brokers) life insurance coverage from several Canadian life insurance companies. Dundas Life currently services clients in Canada, specifically in the provinces of Ontario, Alberta, and British Columbia. Insurance documents and contracts are made between the insurance company and the end user. Prices may vary based on individual factors such as age, gender, smoker status and more.

How to Adjust Journal Entries for Bank Errors

Please reference the final issued insurance documents for more details. See Dundas Life’s Terms & Privacy Policy for more information regarding interacting with our website and service. As with payee names, one in six Scorecard banks offer the ability for customers to input information on checks not yet presented to the bank. In contrast to categorization, this feature does not grow more or less valuable with transaction history length, as it is essentially forward-looking. Categorization raises several issues that go to the heart of the difficulties banks have in making their offerings more useful to customers.

When this happens, the fees work as more of an adjustment instead of a specific transaction. Then, it gets debited from your account and is then recorded as a debit memo. In some cases, debit memos can get used to help rectify inaccurate account balances.

What type of transaction is a memo?

A memo debit is a pending reduction in the cash balance of a bank account, which is a debit transaction.